CA Intermediate Exam as Per New Syllabus 2024

Despite its difficult coursework and exams, the Chartered Accountancy (CA) Intermediate level is an important step toward becoming a chartered accountant. The Institute of Chartered Accountants of India (ICAI) has issued an updated curriculum for the CA Intermediate course to guarantee that prospective chartered accountants (CAs) have access to the most up-to-date knowledge and abilities. In this blog, we’ll go over the important ideas covered in the CA Intermediate New Syllabus, giving candidates a greater knowledge of what to expect and assistance on navigating this hard yet rewarding period of their career.

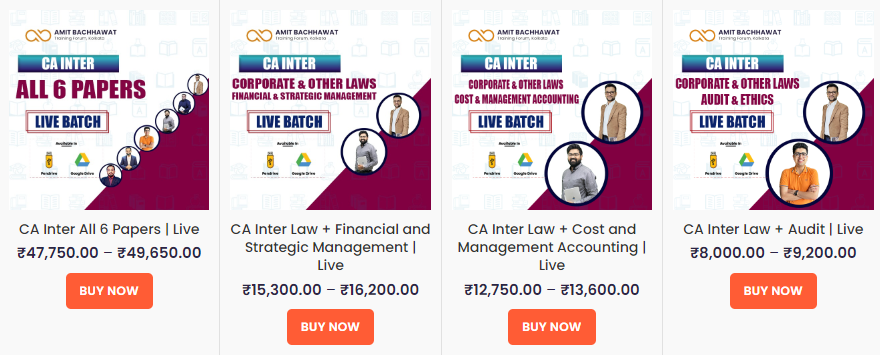

Explore Now : https://amitbachhawat.com/product-category/ca-inter-pendrive-classes/

Table of Contents

Structure and pattern have been updated

In view of the new curriculum, the structure and design of the CA Intermediate test have been updated. Six papers are divided into two groups of three papers each, Group I and Group II. The framework is intended to provide a comprehensive grasp of many aspects of business, finance, and accounting.

Papers for Group I

a. Advanced Accounting:

This section of the CA Intermediate New Syllabus 2024 focuses on the preparation of financial statements using Indian Accounting Standards that are comparable to IFRS, as well as the application of accounting standards to real-world business situations. It also discusses the framework for preparing financial statements and IFRS convergence or implementation.

b. Corporate and Other Laws:

This essay discusses business law, other corporate laws, ethics, as well as legal and regulatory issues. Candidates must be familiar with the laws that govern corporations and corporate governance.

c. Taxation:

Both direct and indirect taxes are covered in this paper. To prepare applicants for the complexities of the taxation landscape. It has 2 sections:

- Goods and Service Tax(GST)

- Income Tax Laws(IT)

Papers for Group II

a. Cost and Management Accounting:

This paper gives candidates the tools they need to manage spending and make business decisions, with a focus on budgeting, performance analysis, and costing methodologies.

b. Auditing and Ethics:

The primary objectives are to comprehend core auditing principles and become acquainted with well-known auditing procedures, approaches, and competencies. Students will also learn how to apply this information successfully in audit and attestation projects.

c. Financial Management and Strategic Management:

Financial management’s primary purpose is to maximize the value of an organization’s money.

Strategic management, on the other hand, concentrates on the big picture, outlining how to create and implement plans that will assist a company in meeting its long-term objectives.

FM and SM are not distinct concepts; rather, they are two sides of the same coin. Excellent financial management is required for effective strategy, and making smart financial decisions requires a full understanding of the business environment. Students that take part in CA Inter gain a comprehensive viewpoint by learning both FM and SM.

Also Read : https://amitbachhawat.com/icai-new-scheme-2023/

Strategies for Preparation

Candidates must use efficient preparation methods given the broad nature of the new syllabus. Creating a study schedule that allows enough time for each paper, preparing with earlier tests and practice problems, and getting advice from mentors or skilled teachers are all necessary steps. Furthermore, candidates must stay current on any modifications or updates made by the ICAI in order to be well prepared for the examinations.

CA Inter New Syllabus 2024

Conclusion

CA Intermediate New Syllabus represents a substantial advancement in integrating the CA curriculum with the needs of today’s corporate sector. Aspiring chartered accountants should approach this stage with the intention of comprehending both the theoretical and real-world applications of the concepts. Candidates can pass the exams and become well-rounded professionals able to make substantial contributions to the finance and accounting industries by actively studying the new syllabus and planning ahead.

Start your journey with CA online classes at Amit Bachhawat Training Forum: